Who is my insurance company?

Plan participants should tell medical providers the insurance is through Luminare Health. Luminare Health manages the confirmation of benefits, eligibility, and processing of claims. The Luminare Health insurance plan uses the Aetna Signature Administrators network of providers. Please do not tell providers you have Aetna insurance, as this will result in providers not being able to verify your benefits.

Is health insurance required for all Postdoctoral IRTA/CRTA and VF trainees?

Excerpt from the NIH IRTA Policy:

All trainees must have adequate health insurance coverage to receive training in NIH facilities. This requirement may be satisfied by a policy held either in the Trainee's name or in another's name with the Trainee identified as a family member. Verification of health insurance enrollment is required. (https://policymanual.nih.gov/2300-320-7#710C5A2E)

What should I do if I lose insurance coverage from a non-FAES plan and need to enroll in the FAES insurance plan?

Loss of coverage is a qualifying event to enroll in FAES Insurance. You must enroll in the FAES insurance plan within 30 days from the loss of coverage date. If you experience a qualifying event to enroll in or change coverage, FAES must receive the following within 30 days of the date of your qualifying event.

- For Enrollment after Loss of Insurance Coverage:

- FAES Election Form (This form can be found under "Member Resources" then "Forms & Document Library".)

- Fellowship Activation Forms (pages 1, 2, and 3)

- The "Effective Date of Change" on page 2 should be the day after the loss of coverage date

- Pages 1 and 3 of the Fellowship Activation Forms must be signed by the fellow

- Page 1 must also be signed by the PI or Fellowship Sponsor

- Proof of loss of coverage (letter from the non-FAES insurance stating coverage, name of insured, and coverage termination date)

- If you are also enrolling a spouse and/or dependents, FAES must also receive:

- Marriage Certificate for spouse and/or Birth Certificates for all child dependents (in English)

- If dependents do not have a social security number, FAES will need a copy of their passports with the stamped date of arrival in the U.S. or I-94 form (dependents must be in the U.S.)

- For Enrollment of a Spouse or Dependent following Loss of Insurance Coverage:

- FAES Change Form (This form can be found under "Member Resources" then "Forms & Document Library".)

- Marriage Certificate for spouse and/or Birth Certificate for all dependent children (in English)

- If enrollment of a spouse or dependents will change your insurance coverage from individual to family coverage, you must also provide FAES with updated Fellowship Activation Forms.

- The "Effective Date of Change" on page 2 should be the day after the loss of coverage date.

- Pages 1 and 3 of the Fellowship Activation Forms must be signed by the fellow

- Page 1 must also be signed by the PI or Fellowship Sponsor

- Proof of Loss of Coverage (letter from your spouse or dependents' insurance plan stating the coverage, names of insured, and coverage termination date)

We will be having a baby soon, what do I need to do to add my newborn to the health insurance plan?

If you have a qualifying event to change coverage, we will need the following within 30 days of the qualifying event date:

- Newborn:

- FAES Change Form (This form can be found under "Member Resources" then "Forms & Document Library".)

- Proof of live birth letter or discharge paperwork stating the date of birth of the child

- Birth Certificate and Social Security Number can be provided later since they may take over 30 days to obtain.

- If this changes the fellow’s coverage from individual to family coverage, we need to update fellowship activation forms.

- Fellowship activation forms: pages 1, 2 and 3

- The effective date of change should be the date of birth of the newborn on page 2

- Page 1 and 3 signed by fellow

- Page 1 signed by PI/fellowship sponsor

I am getting married; what do I need to do to add my spouse to my health insurance plan?

If you have a qualifying event to change coverage, we will need the following within 30 days of the qualifying event date:

- Marriage:

- FAES Change Form (This form can be found under "Member Resources" then "Forms & Document Library".)

- Marriage Certificate

- If this changes the fellow’s coverage from individual to family coverage, we need to update fellowship activation forms.

- Fellowship activation forms: pages 1, 2 and 3

- The effective date of the change should be the date of the marriage on page 2

- Page 1 and 3 signed by fellow

I just arrived at the NIH as a trainee; what do I need to do to enroll in health insurance?

New Hire Enrollments: We will need the following within 30 days of the new hire date.

- FAES Election Form (This form can be found under "Member Resources" then "Forms & Document Library".)

- Fellowship activation forms: pages 1, 2 and 3

- The level of coverage selected on page 2

- Page 1 and 3 signed by fellow

- Page 1 signed by PI/fellowship sponsor

- If they are enrolling dependents (spouse or children)

- Proof of relationship: marriage certificate for spouse and birth certificate for children

- If the dependents do not have a social security number, we will need:

- A copy of their passports with the stamped date of arrival in the U.S. or I-94 form (dependents must be in the U.S.)

How much of the monthly premium do I have to pay?

Your institute will provide non-FTE Fellows with an additional stipend amount to cover reasonable health care costs, upon request and certification to your designated Administrative Officer. Please inquire with your Administrative Officer how the insurance premium is dispersed.

How do I submit a medical claim for reimbursement to Luminare Health?

What do I do if my medical claim is denied and I want to appeal the decision?

For information on a denied claim, you can contact Luminare Health Customer Service at 888-270-2044. The FAES Insurance team is available to assist you with navigating the claims and appeals process.

Information on appeals can be found in the paperwork with your explanation of benefits (EOB) from Luminare Health. Complete, detach, copy and send in the form provided on your EOB within one hundred eighty (180) calendar days from receipt of notification of the denial. Include the reasons you feel the claim should not have been denied along with any additional information and comments relevant to the claim. You are entitled to receive, upon request and free of charge, copies of all documents relevant to the denial. You will be notified of the decision within a reasonable period of time, not later than 60 days after the plan receives your request for review.

Please see the Insurance Claims and Verification Info Sheet for more information.

What do I do if I receive a medical bill from a provider?

For in-network providers:

- Review the bill and check if it notes any payment from the insurance carrier, Luminare Health.

- If the bill does not contain insurance payment information, please contact the provider’s office and inform them of the insurance information on the front of your ID card.

- Request your provider to submit the claim for processing to Luminare Health.

- If you encounter issues or have questions during this process, please contact the FAES Insurance Department for additional assistance.

For out-of-network providers:

In most circumstances, out-of-network providers will not submit a claim on your behalf. Complete a Luminare Health Claim Form with proof of payment and documentation.

If you encounter issues or have questions during this process, please contact the FAES Insurance Department for additional assistance.

What do I do if I need to submit a prescription claim?

Am I covered while I am traveling abroad?

There is no network to access your FAES medical and prescription drug plan outside of the US. If you

have a medical emergency and are outside of the US – here are your care options:

1. Utilizing your FAES medical and prescription drug coverage while outside of the US: You

are only covered in a true emergency. The FAES medical and prescription plan only

covers emergency care outside the US. To help define what constitutes emergency care, please

see below:

An accidental injury, or the sudden onset of an illness where the acute symptoms are of

sufficient severity (including severe pain) so that a prudent layperson who possesses an

average knowledge of health and medicine could reasonably expect the absence of

immediate medical attention to result in:

- Placing the covered individual’s life (or with respect to a pregnant woman, the

- health of the woman or her unborn child) in serious jeopardy or

- Causing other serious medical consequences, or

- Causing serious impairment to bodily functions, or

- Causing serious dysfunction of any bodily organ or part.

Please note that if you have an emergency and need to seek care, you will have to pay the

costs upfront out-of-pocket. You will then submit for reimbursement and will need to

provide supporting documentation. You are responsible for all out-of-network

deductibles, copays, and coinsurance. It is highly recommended before you leave the

facility to get all documentation with details surrounding procedures, treatments, codes,

and proof of payments.

2. While in the country of your home residence, You need to evaluate your access to care options

as a resident of your home country.

My NIH Fellowship is being renewed for another year. What do I need to do to make sure my health insurance plan doesn’t stop?

Please provide FAES with the NIH Fellowship Activation Form to renew your health insurance. This can be obtained from your Administrative Officer. FAES requires pages 1, 2, and 3 of the 6 pages of the NIH Fellowship Activation Form. The form must be signed by your sponsor on page 1. The Fellow will need to sign pages 1 and 3.

I am leaving the NIH; what are my options?

All Fellows must provide a Fellowship Termination Notification to FAES when leaving the NIH or transitioning to a full-time employment position (FTE) with NIH. The form may be faxed to 301-480-3585 or emailed to faesinsurance@mail.nih.gov.

Our continuation of coverage administrator, BRI, will send follow-up information on how to continue health insurance coverage.

What are my continuation of coverage benefits?

When any covered member loses health insurance coverage based on a termination of employment or the occurrence of other qualifying events, the member will be eligible to elect continuation of coverage. Once your termination of health insurance coverage is processed, you will receive a continuation of coverage packet in the mail from our administrator, BRI. You will have 60 days to elect for continuation of coverage. Once elected, your coverage is retroactive to the date you lost coverage. There will be no lapse in coverage. Please contact an FAES insurance representative for additional information on pricing regarding the continuation of coverage.

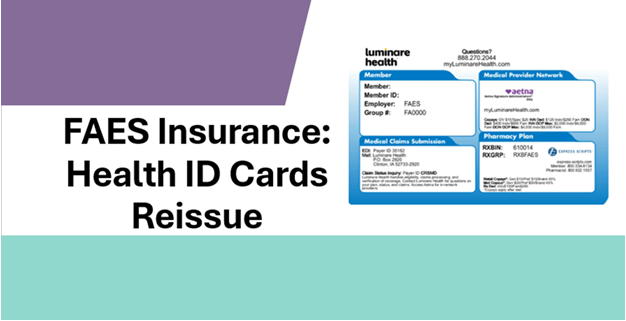

Will my spouse and/or dependents receive a health insurance card?

All covered plan participants will receive their own insurance card with their name listed.

What if I need to see a doctor before I get my insurance card?

Please check with an FAES insurance representative if a temporary card is available. Cards are mailed within 7-14 business days of the processing of your enrollment.

How do I obtain the insurance plan documents?

Plan documents are available upon request. Please contact a FAES insurance representative.

What can I do if I lost my member ID card?

I never received my member ID card; what should I do?

Please contact FAES Insurance via email or phone, and we can assist with providing a PDF of your card.

Are domestic partners eligible to be covered under the plan?

Domestic partners are not eligible. Eligible dependents are spouse or dependent children. FAES requires proof of relationship for dependents. For a spouse, we require a marriage certificate. For dependent children, we require a birth certificate, legal adoption paperwork or legal dependent status documentation.

Is dental covered under my plan?

Yes, FAES plan participants have dental coverage through MetLife.

How do I find a dental provider?

Our dental plan is through MetLife. You can visit metlife.com and choose our plan (Dental PDP Plus) to find an in-network provider.

Will I receive a MetLife Dental card?

No, you will not be mailed a separate MetLife Dental card. The MetLife Dental group number and contact information is included on the back of your Luminare ID card.

If you want a dental specific member ID card, members can obtain a dental ID card by creating an account with metlife.com/mybenefits.

What do I do if I don't see my active dental benefits on my metlife.com/mybenefits account?

If your created an account prior to 11/1/2025, you will need to link your current dental policy to view the November 1, 2025 to October 31, 2026 plan year benefits.

Please review page 28 of the FAES Insurance Benefit Guide for instructions on how to link the current policy.

Is an annual eye exam covered?

Yes, the medical plan covers an annual eye exam covered at 100% for both in-network or out-of-network providers.

Can I terminate my plan at any time?

Subscribers covered under the plan can only terminate at Open Enrollment (usually in September) unless they have a qualifying event. A qualifying event to terminate insurance outside of Open Enrollment would be marriage or newly obtained coverage elsewhere. Fellows have 30 days to notify FAES of this qualifying event to terminate coverage.

Are telemedicine visits covered?

Yes, below is the in-network and out-of-network coverage. Please consult with your provider if they are capable of telemedicine visits.

In-network telemedicine visits:

- Primary Care Provider: $15 Copayment

- Specialist: $25 Copayment

Out-of-network telemedicine visits:

Can I be enrolled as the primary subscriber and a dependent under a spouse’s policy if both policies are under the FAES plan?

No, you can only be enrolled as the primary subscriber or a dependent but not both under the FAES plan.